The German economy has provided a largely positive report on the private equity industry. Financial investors can assist companies as powerful partners especially in difficult situations, say 82% of companies. It is also expected that companies in crisis that have financial investors in their ownership group can succeed in making a quicker turnaround. In an industry analysis by the corporate consulting company Staufen, for which more than 200 shareholders, chairs, and managing directors of German companies were surveyed, it also becomes clear that private equity managers are frequently lacking a deep understanding of the operative day-to-day business of the companies in their portfolio.

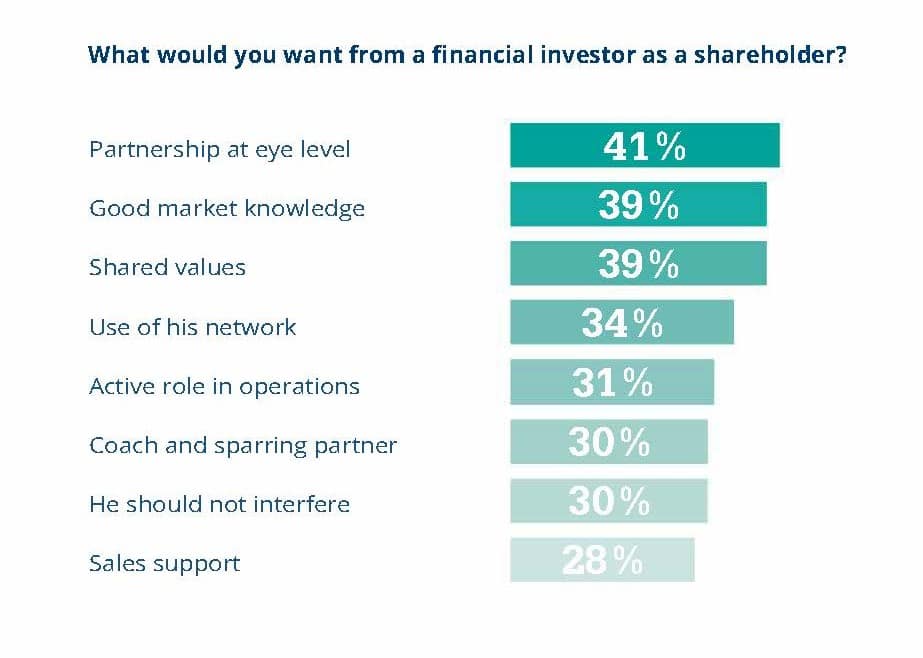

The conclusion from the “Private equity industry paper” is clear: investors are needed, and their strengths are appreciated, however companies would like an exchange on equal footing. “The foundation of a successful cooperation is a partnership that relies equally on common values such as excellent industry expertise,” says Christoph Wurst, who leads the Private Equity and Banking division at Staufen AG. Only if partners have a mutual understanding can the mix of entrepreneurial creativity and financial expertise with a strong capital base realize its full potential.

According to corporate consultant Wurst, who himself was a senior investment manager at a holding company for many years, the private equity industry enjoys a good reputation in the economy. Two thirds of the companies have no prejudice against financial investors, and eight out of ten even assume that these can achieve a turnaround more quickly than other shareholders, according to the results of the Staufen study.

Great potential is no longer hidden in the balance sheets

Given disturbed supply chains, the private equity industry has been confronted with many inquiries and new challenges. According to the view of industry expert Wurst, financial investors are in demand as both firefighters as well as catalysts. In most cases, fresh capital is needed because of the threat of financial distress, growth must be financed, or new markets should be explored.

The Staufen study has also revealed weak points on the part of private equity companies. “As financial experts, they have wandered into all facets of financial engineering. Depending on industry management, however, deep insight into what happens in the plants is also required. For great potential is no longer hidden in the balance sheets. Instead, the goal is to harmonize existing systems, optimize organizations, and achieve sustainability goals at the same time,” says Christoph Wurst. Important for success is therefore a partnership on equal footing, one that also incorporates external expertise.

Dr. Anselm Stiehl, Managing Director of Harald Quandt Industriebeteiligungen GmbH, therefore reminds companies about thorough partner selection in the “Private equity industry paper”. Frequently, shareholders decide to whom they sell solely based on the achievable price. But the question of whether the buyer fits well with the company is more important: “The investor profile contains essential characteristics that can determine the success or failure of the partnership. A seller should therefore engage intensively with potential buyers in advance to prevent misunderstandings and disappointed expectations.”

Study and private equity industry paper

For the study for the “Private equity industry paper”, the consulting company Staufen surveyed a total of 200 top-level executives in Germany (shareholders, board members and managing directors). About half of the companies of the shareholders and managers surveyed are from the industrial sector, 18% are from trade and 31% are from the service sector. For the study, only companies with annual sales of at least 20 million euros were considered; just under a third of the companies included in the study recorded annual sales of more than 100 million euros.

The industry paper including study is available for download free of charge under the following link:

For more information:

STAUFEN.AG

Consulting.Academy.Investment

Stephanie König

Blumenstr. 5

D-73257 Köngen

Mobile: +49 1522 2887 350

s.koenig@staufen.ag

Press

Thöring & Stuhr

Kommunikationsberatung GmbH

Arne Stuhr

Mittelweg 142

D-20148 Hamburg

Mobile: +49 177 3055 194

arne.stuhr@corpnewsmedia.de

About Staufen AG – www.staufen.ag

Creating value. Appreciating value. Increasing value.

Inside every company there is an even better one. With this conviction, Staufen AG has been advising and qualifying companies and employees since 1994. Staufen AG offers its customers a unique combination of specialist consulting and organizational development. It is only when process excellence and leadership excellence are integrated that a sustainable culture of change can be ensured in the company in the long term. With the right strategies and methods, Staufen AG quickly sets the necessary changes in motion and achieves measurable success. The consulting firm supports managers and employees in demand-oriented roles – consulting, coaching, and qualifying – in establishing a performance-promoting and appreciative corporate culture and thus increasing value creation in their company. This is how Staufen AG increases company value of the company. With 340 employees worldwide, the international Lean Management consultancy serves customers in the competence areas of operational excellence, supply chain network management, organizational development, leadership excellence, digitalization, and Industry 4.0. The Staufen Academy also offers certified, practically oriented and tailored qualifications. In 2021, Staufen AG was named “Best Consultant” for the eighth time in a row and has now been named Germany’s best Lean Management consultancy according to the “Hidden Champions 2022/23” industry study by the Wissenschaftliche Gesellschaft für Management und Beratung (WGMB).